Throughout their professional careers, appraisers have always had to navigate changes related to market fluctuations, compliance, education and regulation. Today, the biggest factor shaking up the industry is modern technology. Modern technology presents an opportunity for appraisers to maximize their earnings by allowing them to complete orders more efficiently. Thanks to advances in technology, appraisers can focus on the valuation – rather than time-consuming and distracting administrative tasks and logistics.

Digitization has transformed the broader mortgage process by reducing turn times, providing new levels of transparency and enabling a more modern digital consumer experience. Lenders are closing loans weeks faster than they did just a year ago, all with the help of new digital mortgage tools. Now is the time for independent appraisers and appraisal management companies (AMCs) to take the leap into the world of digital technology as well.

New digital tools, like complexity models, property data received with each order, and real-time calendars that allow consumers to instantly schedule appraisal appointments for the exact date and time of their choice, have proven to reduce appraisal report turn times. Early adopters say appraisers should view technology as a tool to help them. “I was skeptical at first but I thought, I’m just going to take the leap and trust that it will work, and it has worked for me,” said Brian Corbin, an appraiser who adopted a digital solution. These tools enable appraisers to spend less time tracking down homeowners and more time doing actual appraisal work.

Changing Workflows

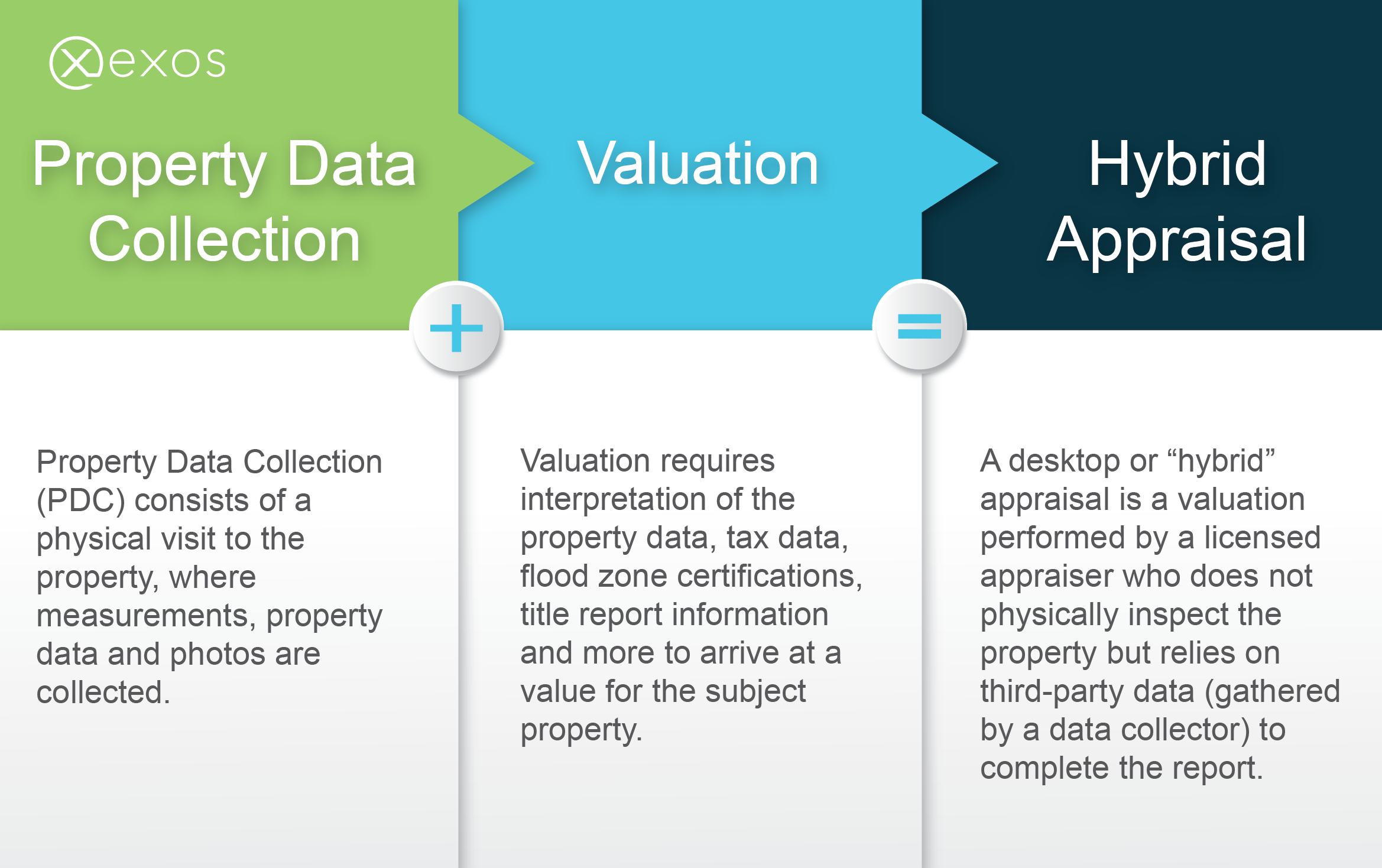

So much more is changing for appraisers than the addition of modern technology. In March 2019, Fannie Mae made a major announcement about valuation requirements. Viewed by some as a seismic shift in the role and scope of the appraiser, Fannie debuted its Property Data Collection (PDC) pilot program. The concept involves using a data collector to visit a home and report on the characteristics of the property. The information collected during the PDC can be used in conjunction with an appraisal.

The program has several options:

- Accept loan without an appraisal

- Order traditional appraisal

- Order desktop (hybrid) appraisal that incorporates information from data collector (1004P form)

A desktop or “hybrid” appraisal can be defined as a valuation performed by a licensed appraiser who does not physically inspect the property but relies on third-party data (gathered by a data collector) to complete the report. The property visit, measurements, property data, pictures and opinion of value have traditionally fallen to the same appraiser. However, with the PDC program, appraisers may receive property data previously collected by someone else.

While Fannie’s 1004P product sounds like a whole new approach for lenders to potentially speed up turn times, the concept of relying on third-party data is not new. For decades, appraisers have leveraged existing property tax data, flood zone certifications, title report information and other third-party data for their reports. What’s different in this case is that someone else is collecting the physical property information. This change allows the appraiser doing the valuation to focus on that task.

Hybrid Appraisals: The Appraiser Remains the Expert

“Hybrid” appraisals provide appraisers the opportunity to interpret data – without having to spend their time collecting it. Despite not physically taking measurements and photos, they remain empowered to interpret the data and provide their opinion of value. As Fannie Mae notes, the data “is strictly observation, measurement, and fact.” Appraisers must continue to provide the checks and balances for one of the most important investments a person will likely ever make.

Proponents argue that “hybrids” allow experienced appraisers to more appropriately use their expertise by focusing on complex work, while someone else visits the property and collects data. This reduces the amount of time spent on logistics: scheduling and traveling back-and-forth between sometimes far-flung subject properties and the office. Meanwhile, appraisers who prefer working in the field can continue to perform PDC and traditional appraisals.

Appraisers approaching retirement who still want to work, but find it too physically demanding to inspect properties, may benefit from the hybrid approach. It may also spark interest in the industry among a younger demographic interested in utilizing different technologies.

Ultimately, Fannie Mae’s modern version of the appraisal process has sparked a shift in the valuations business. For many, “hybrids” have opened up a new avenue of opportunities. However, plenty of work remains for appraisers who prefer to continue to focus on more traditional appraisals and on PDC.

Looking forward

When considering partnering with an AMC, appraisers should be sure they select a company equipped to navigate this new landscape for appraisals. Appraisers should look for AMCs with experience offering similar products. ServiceLink, for example, is uniquely positioned to guide appraisers through these changes and trends as it has been providing valuation solutions for decades. Both it and its predecessor companies have been offering “hybrid” products since 2005.

Increased demand for hybrid products requires that appraisers handle traditional appraisals as efficiently as possible. ServiceLink’s EXOS Valuations platform provides appraisers with the tools they need to be successful in today’s appraisal environment. Featuring instant calendar sync technology, EXOS Valuations eliminates phone tag, voicemails, and chasing business from appraisers’ routines. Instead, appraisers simply update their mobile calendars for the times and locations that they are available and receive appraisal appointments in real-time. And, in the same application, appraisers can view assignment details, payments, performance and more. EXOS Valuations allows appraisers to focus on valuation – not logistics.